Routing numbers play a crucial role in the banking world, especially in the United States. They serve as identifiers for banks and financial institutions, ensuring that your money reaches the right destination. One such number that holds particular significance is 267084131, a Chase routing number. This article delves deep into the world of routing numbers, focusing on 267084131, its uses, and how it can make a difference in your financial transactions.

By the end of this article, you’ll have a clearer understanding of routing numbers, their impact on ACH (Automated Clearing House) transactions and wire transfers, and why Chase routing numbers, like 267084131, are key players in the banking ecosystem. Whether you’re an individual or a business owner, learning about routing numbers will optimize your banking experience and help you avoid unnecessary fees.

Contents

What is a Routing Number?

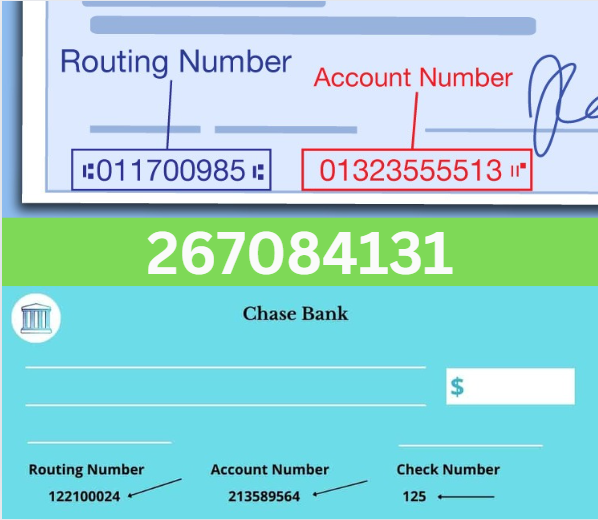

A routing number is a nine-digit code assigned to a financial institution, primarily used in the United States. These numbers are critical in facilitating the accurate transfer of money between banks, particularly for electronic payments like direct deposits, bill payments, and wire transfers.

In essence, the routing number acts like an address for the bank, pinpointing its location to ensure that funds reach the correct recipient.

Key Uses of Routing Numbers:

- Direct Deposits: Employers use routing numbers to deposit paychecks into employees’ accounts.

- Bill Payments: When you set up automatic bill payments, the routing number ensures the money is drawn from the right bank.

- Wire Transfers: For sending or receiving money internationally or domestically, routing numbers are crucial.

- ACH Payments: Automated Clearing House transactions, such as payments made through payment platforms, utilize routing numbers like 267084131 to process the transfer.

The Specifics of 267084131

Routing number 267084131 is associated with Chase Bank and is designed to accept both ACH (Automated Clearing House) transactions and wire transfers. What makes this number particularly notable is that ACH transfers processed using this number are fee-free, unlike wire transfers, which often incur charges.

267084131 and Chase Bank: A Powerful Combination

Chase Bank, one of the largest financial institutions in the United States, uses a variety of routing numbers across different states and regions. 267084131 is one of Chase’s key routing numbers, playing a vital role in ensuring smooth transactions for customers, particularly those located in the southeastern region of the United States.

Why Choose ACH Over Wire Transfers with 267084131?

One of the main advantages of using routing number 267084131 for ACH transfers is that it helps you avoid wire transfer fees. ACH transfers are electronic transfers between financial institutions that operate through a centralized clearinghouse, ensuring quick, secure, and reliable transactions at a lower cost. Wire transfers, on the other hand, can be faster, but they are also often more expensive.

For businesses and individuals alike, avoiding unnecessary fees while still ensuring efficient payment processing is a significant advantage. By choosing ACH transactions through 267084131, Chase customers can streamline their finances while maintaining control over their expenses.

Chase Bank’s Financial Services: Leveraging 267084131

Chase Bank offers a broad range of financial services for both personal and business banking. Whether you’re setting up direct deposits for payroll, paying bills, or handling international transfers, Chase routing numbers like 267084131 provide a trusted gateway for your financial transactions.

Personal Banking with 267084131

For personal banking, Chase routing number 267084131 simplifies transactions such as:

- Direct deposits for your paycheck or government benefits.

- Online bill payments that ensure automatic deductions from your account.

- ACH transfers for sending or receiving funds from family and friends, often without incurring extra fees.

Business Banking with 267084131

Business owners can also benefit significantly from using 267084131, especially when managing payroll and vendor payments. ACH transfers allow for automated payments that save time, reduce manual work, and prevent human error.

Chase’s International Wire Transfers and 267084131

If you need to send or receive money internationally, 267084131 can also be used for wire transfers. Wire transfers through Chase are typically more expensive but faster. For businesses involved in global trade, this routing number enables you to make swift payments, helping ensure timely transactions with international partners.

Understanding ACH vs. Wire Transfers with 267084131

Now that you know the importance of 267084131 and its role in Chase Bank’s financial services, let’s dive deeper into the two main methods of money transfer: ACH and wire transfers.

ACH Transfers: A Cost-Effective Solution

ACH (Automated Clearing House) transfers are the backbone of most electronic payments in the United States. They allow individuals and businesses to transfer money electronically between bank accounts. When using 267084131 for an ACH transfer, you typically won’t incur any fees, making this an attractive option for regular transactions.

Key Benefits of ACH Transfers:

- No transaction fees: ACH transfers via 267084131 are usually fee-free, making them the ideal option for routine transactions.

- Convenient and efficient: ACH payments can be scheduled automatically, making it easier to manage recurring bills, payroll, or transfers.

- Safe and secure: ACH transactions offer a secure way to move money between bank accounts.

Wire Transfers: Speed with a Price

Wire transfers, on the other hand, are processed in real-time, making them the fastest option for sending and receiving money. However, this speed comes with a price. Most wire transfers incur fees, whether they are domestic or international. While 267084131 can facilitate wire transfers, Chase typically charges fees for both outgoing and incoming wires.

Key Benefits of Wire Transfers:

- Speed: Wire transfers are processed quickly, sometimes within the same business day.

- Global reach: Wire transfers are often the go-to option for international transactions.

- High-value transactions: For larger sums of money, wire transfers offer added assurance and rapid processing.

ACH vs. Wire: Which to Choose with 267084131?

For day-to-day transactions, such as paying bills or receiving your paycheck, ACH transfers via 267084131 are your best bet. They’re free, secure, and efficient. However, if you’re dealing with large sums or need to send money quickly — particularly to international accounts — a wire transfer might be more suitable, even though it comes at a cost.

How to Use Routing Number 267084131 for Your Transactions

Using 267084131 for your financial transactions is straightforward. Here’s a step-by-step guide to help you make the most of this Chase routing number:

- Locate Your Chase Account Number: Your account number is typically found on your checks or in your online banking profile.

- Use Routing Number 267084131: When setting up ACH transfers, direct deposits, or wire transfers, input 267084131 as the routing number for your Chase account.

- Select ACH or Wire: Depending on your needs, choose between an ACH transfer (for routine, fee-free payments) or a wire transfer (for faster, higher-priority transactions).

- Confirm the Details: Double-check all the details before confirming your transfer to avoid errors or delays.

- Track Your Transfer: Chase’s online banking platform allows you to monitor your transaction in real time, ensuring that your funds reach their destination.

FAQs about 267084131

1. What is 267084131?

267084131 is a Chase routing number used primarily for ACH transfers and wire transfers.

2. Can I use 267084131 for international wire transfers?

Yes, 267084131 can be used for both domestic and international wire transfers. However, keep in mind that wire transfers typically come with fees.

3. Is it better to use ACH or wire transfers with 267084131?

For routine, domestic transactions, ACH transfers via 267084131 are more cost-effective since they do not incur fees. For urgent or high-value international transfers, wire transfers may be a better option despite the cost.

4. Are there any fees associated with using routing number 267084131?

While ACH transfers via 267084131 are generally fee-free, wire transfers (both domestic and international) may incur fees.

5. Where can I find my Chase routing number?

You can find your routing number on your checks, within your online banking account, or by contacting Chase customer service.

Conclusion

Routing number 267084131 is more than just a series of digits; it’s a powerful tool for Chase customers who want to optimize their financial transactions. By leveraging this routing number, you can make the most of ACH transfers, saving on fees and ensuring seamless transfers. However, for high-priority transfers, wire transfers are also available, though they come at a cost. Understanding the best use cases for 267084131 will help you streamline your banking activities, making your financial life easier and more cost-effective.

Whether you’re paying bills, receiving direct deposits, or transferring money internationally, 267084131 can help you do it all efficiently and securely.